As peace prevails, the banking sector has performed well in the last fiscal. Though the focus remains on cleaner balance sheets, State Sponsored Schemes and corporate credit, the policymakers may have to skip drastic drives and reassess the evolution of the sector in Jammu and Kashmir to locate the grey areas preventing smooth growth and exhibiting chronic stress, reports Masood Hussain

At the bourses, the stocks of Jammu and Kashmir’s premier listed company the Jammu and Kashmir Bank (JKB) are bullish, especially since the last five years of the share-split era. Part of the contributions that make the bank stock a very promising investment is the historically high profit that the bank netted in 2022-23. It was a quantum jump over Rs 2019-20 when it booked a loss of Rs 1139.41 crore.

In the year ended March 2023, the bank netted a profit of Rs 1197 crore, the highest in its history. Even in the first quarter (Q1) of 2023-24, the net profit of the bank was Rs 326.45 crore, which was almost double the amount it netted in the Q1 of the last fiscal.

“Right now, the bank has the strongest balance sheet in the banking sector,” one professional banker, who spoke on the condition of anonymity, said. “It does happen in banks after a phase of bleeding but in the case of JK Bank, the rebounding has been phenomenal.”

The bank has historically remained what banking denotes in Jammu and Kashmir. A general belief is that if JK Bank is doing well, every other bank will also be doing better. For many decades now, the banking in Jammu and Kashmir has remained what the JKB would say or do.

So if the JK Bank did well in the last fiscal, how better was the performance of the banking sector in Jammu and Kashmir?

In Jammu and Kashmir, financial inclusion is much better than all other states across India. Against an estimated population of 14,999,397, Jammu and Kashmir has 14541052 accounts – other than business accounts, in operation by the end of last fiscal. This essentially means the working of the banking sector must offer an informed narrative about the state of the economy.

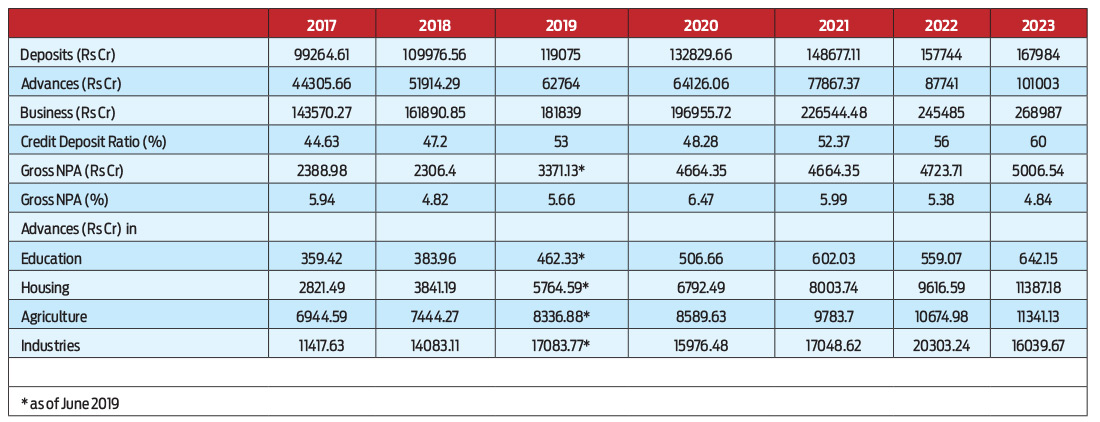

Deposits

The growth in deposits has been marginal. From Rs 157744 crore in 2021-22, the bank vaults in Jammu and Kashmir are holding Rs 167984 crore – a net increase of Rs 10240 crore, a growth of 6.49 per cent. The deposit growth in all markets is sluggish but data suggests a marginal fall indicating the people have not much to save. Jammu and Kashmir is very popular within the banking sector for its better CASA ratio because it fetches banks low-cost funds for deployments with better margins.

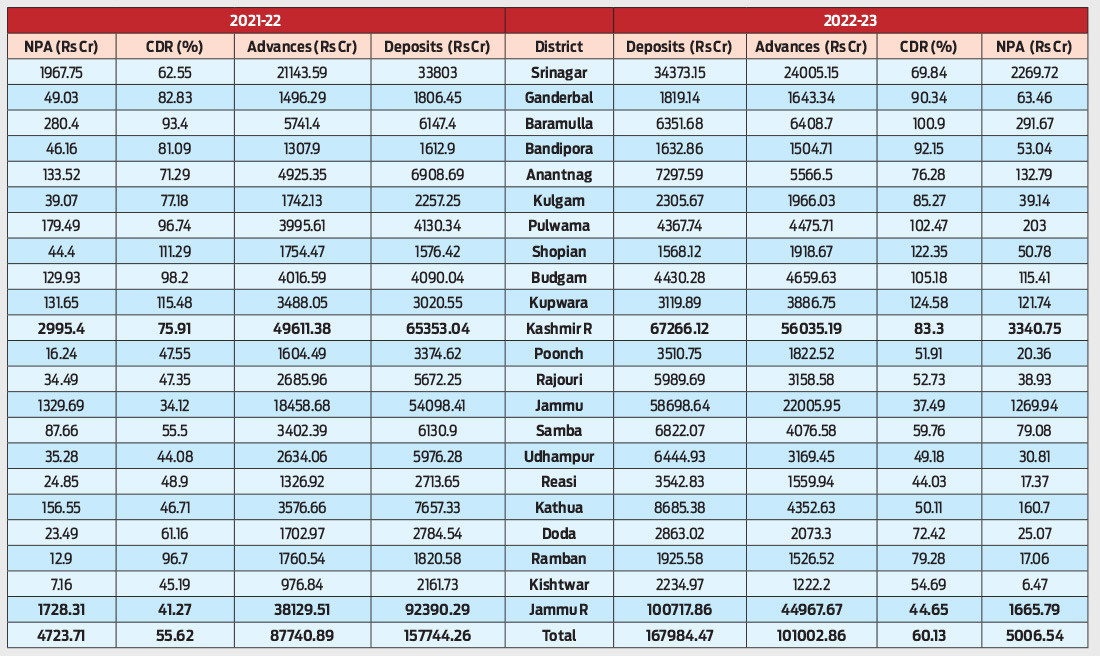

What is interesting is that in certain Kashmir districts, the deposits have shown negative growth. While it is completely negative in the case of Shopian, the districts of Ganderbal, Bandipora and Kupwara have exhibited a very marginal increase in the quantum of saving deposits in comparison to the last final year (2021-22).

Advances

The overall banking sector has shown better growth for advances. Against the loan book of Rs 87740 crore in 201-22, the advances reached Rs 101002 crore by the end of the last fiscal – a net growth of Rs 13262 crore, which is a growth of 15.11 per cent.

Advances exhibited a huge fall in 2021-22 when the entire sector could disburse only Rs 9067 crore, much less than Rs 15847 crore that it advanced in 2020-21.

What is interesting, however, is that corporate sector lending is substantial. It was Rs 5800 crore in 2021-22 and Rs 6957 crore in 2022-23. At the same time, personal loans are exhibiting a surge. The overall advances under the personal loan sub-category have reached Rs 31890 crore by the end of the last fiscal, an increase of Rs 4745.81 crore in a year.

If the overall outstanding is classified sector-wise, then, by the end of March 2023, Rs 11072.13 crore is in primary agriculture sector; Rs 16039.67 crore is in the industry sector; Rs 541.82 crore is in education sector; Rs 5650.42 crore is in housing sector; a paltry Rs 18.05 crore is in social infrastructure; Rs 16.06 crore is in renewable energy sector; and balance Rs 1847.97 crore is outstanding in other sectors.

New Markets

Credit appetite does not necessarily mean the people are debt-funding livelihoods. It essentially means that people are investing in new businesses. For many years, it was the tiny Shopian district that was exhibiting a massive credit craving and thus topping the districts across Jammu and Kashmir on the credit thirst front. It has slightly changed. The deposits in the district have negatively grown in a year even though it has recorded a 122 per cent of credit to deposit ratio.

For the second consecutive year, it is the border Kupwara district that is topping the credit chart. In 2021-22, its CDR was 115.48 per cent, which jumped to 124.58 per cent in 2022-23.

While Shopian retains the second slot, it is Budgam at 105.18 per cent, Pulwama at 102.47 per cent, and Baramulla at 100.9 per cent. CDR means the actual disbursement of loans in a particular area in comparison to the deposits the same area has. While it is the apple dominating the scene in Shopian and Pulwama and probably the real estate in Budgam, it remains to be seen what is driving the credit appetite in Kupwara and Baramulla.

What is disturbing is that Srinagar, the main business hub of Kashmir, is falling at No 10, in Kashmir, as far as credit requirement is concerned. This could be because the focus in banking is Srinagar as far as recoveries go.

On a regional basis, Kashmir is exhibiting a considerable credit appetite in comparison to the Jammu region. The exciting part is that Jammu is exhibiting no credit demand. With a CDR of 44.65 per cent, Jammu is seeking only around half of what the credit requirement of Kashmir was in 2022-23 – 83.3 per cent. It essentially means it is Kashmir that is the bread and butter of the banking sector in comparison to Jammu which has more deposits than Kashmir. By the end of 2022-23, the Jammu region had Rs 100717.86 crore deposits, which is almost one-third more than that of Kashmir – Rs 67266.12 crore.

In the Jammu region, it is the poverty-stricken Ramban district that is exhibiting a massive credit appetite with a CDR of 79.28 per cent. The second district is Doda. The entire eight districts are reporting a low CDR and fall much below Kashmir’s least creditworthy district.

Annual Credit Plan (ACP)

In anticipation of a new financial year, the bankers meet and draft a plan about how much to advance, where and how. Banks discuss almost everything but the focus remains on the priority sector lending. This lending is a must and the regulator bank, the RBI has already decided that 40 percent of net adjusted advances must go to the priority sector. The priority sector is a basket of eight categories including agriculture, MSME, Housing, Export Credit, Education, Social Infrastructure, Renewable Energy and others. All the government-sponsored schemes fall under priority sector lending. If banks do not ensure the priority sector lending as per the requirement set by the RBI, they are penalised.

Having targets and not achieving them in the priority sector is just a new norm. In 2022, the banking sector in Jammu and Kashmir was supposed to lend a credit of Rs 35,482.62 crore in the priority sector. The actual disbursement was Rs 19,095.87 crore. It was the same story last fiscal when the banks disbursed Rs 26,411.85 crore against a target of Rs 40,342.37 crore.

The reasons for under-performance in priority sector lending are basket-full. Banks earn less in the priority sector, have to coordinate with various government departments for part-funding of the interest subvention, have low ticket size, have too much stake-holding and the pace of bad asset-making is quite fast. Every bank intends to have low default and good earnings. Bankers in private admit that they would never do the PSL if given a chance. That is perhaps why some of the government-sponsored schemes are not doing well and are unlikely to do well in the coming days. This is despite the fact that the policymakers in Jammu and Kashmir and top management in certain banks have a complete focus on these schemes only.

The banks, however, are robust in non-priority lending because it is the main bread and butter. In 2021-22, they had set a target of Rs 9,497.95 crore and ended up lending Rs 17,662.47 crore. Last fiscal (2022-23) against the target lending of Rs 10447.71 crore, the banking sector actually disbursed Rs 33,636.42 crore of credit.

Banks actually doubled their lending on a year-on-year basis if priority and non-priority are tabulated together. Against Rs 36,758.34 crore in 2021-22, it was Rs 60,048.27 crore in 2022-23.

Non-Performing Assets (NPA)

Of all the banking terms in vogue off and online, it is the NPA that has been dominating the banking and political discourse for the last many years. Seemingly it is aimed at questioning the creditworthiness of the Jammu and Kashmir creditors after delinking their operations from the challenges their ecosystem faced for all these decades.

By the end of March 2023, the overall gross non-performing assets in Jammu and Kashmir were at Rs 5006.54 crore, which is 4.96 per cent of the entire loan book of Rs 101002.86 crore. The situation has improved drastically in the last year when the NPA was at Rs 4723.71 crore, which was 5.38 per cent of the overall lending by March 31, 2022. In one year, the NPAs within the MSME sector were managed by nearly half. It was Rs 1648.32 crore in 2021-22, which fell to Rs 979.68 crore by the end of March 2023.

The NPAs are supposed to be in every kind of lending. In the agriculture sector, the NPAs stood at Rs 997.12 crore (9.01 per cent); Rs 979.68 crore (6.11 per cent) in MSME, and Rs 394.31 crore in Mudra – PMMY making almost 4.11 per cent of lending under stress. National Rural Livelihood Mission (NRLM) has an NPA of Rs 6.06 crore, PMEGP has 2.9 percent of its lending as NPA making it Rs 85.57 crore and National Urban Livelihood Mission has an NPA of Rs 13.42 crore which is 10.8 percent of the overall credit extended to the state-sponsored scheme. Almost five percent of the Kisan Credit Cards (KCC) are NPA right now making a gross stressed asset worth Rs 264.27 crore.

On the district level, it is Srinagar that tops the chart. It has Rs 2269.72 crore gross NPA, which is much more than all the 10 Jammu districts put together with Rs 1665.79 crore.

In the overall ranking, it is Srinagar, followed by Jammu, Baramulla, Anantnag, Budgam and Kupwara.

Insiders in the banking sector suggest the net NPA in Jammu and Kashmir’s banking sector must be one of the lowest in India. They assert that the over-emphasis on the parameter is so scary that some of the accounts barely exhibiting stress are pulled into NPA.

Admitting that for the last few years almost every day is a working day, unlike in the past, the stakeholders insist that the banks are not making any effort to understand the chronic legacy crisis and the business nosedive post-2018 coupled with the inflation and lack of peoples’ purchasing capacity. The businesses in Jammu and Kashmir have thrived in troubled situations when the transactions were happening. Now when the tensions on working conditions have gone down, the transactions have evaporated.

The JK Bank

In this entire banking story, if the Jammu and Kashmir Bank is taken out, the entire sector collapses. This is because the JK Bank continues to be the daddy of banking in Jammu and Kashmir because of its reach, emotional and physical investment and age-old stake-holding in the economic well-being of the place.

In 2022-23, JK Bank’s share in the priority sector was Rs 17955.08 crore which is 67.98 percent of the overall credit flow in the priority sector. In non-priority, it was Rs 21315.04 crore which is 63.36 per cent of the total from the banking sector. This essentially means, in 2022-23’s ACP, JK Bank owned 64.95 per cent – almost two third of the total. In the earlier fiscal, it was 64.29 per cent. In Jammu and Kashmir, more than 63 per cent of the savings accounts are with JK Bank.

Nearly two third of the entire gross NPA belongs to JK Bank because it has the maximum exposure in the loan book.

Off late, however, the JK Bank is shedding part of the space that has historically remained its own. In 2019, JK Bank was holding 72.03 per cent of the entire deposits in Jammu and Kashmir. By the end of 2022-23, it has reduced to 63.50 per cent. In 2019, its share in overall advances in Jammu and Kashmir was 69.32 per cent, which by the end of March 2023 had reached 58.51 per cent. This has slightly altered the numbers for other banks. While the weight-shedding does not compromise the status of JK Bank as the main banking driver in Jammu and Kashmir, it remains to be seen whether it is pilferage or a policy.

(Note: There was an error in the print edition in which the figures of deposits were erroneously shown as that of advanbces too. The mistake was corrected.)